|

Description:

|

|

On this Weekend’s Show we look ahead to next year when the Fed has stopped hiking rates. We are not predicting how many more hikes are coming but rather what the market and economic environment looks like with rates flat.

Please keep in touch with Shad and I through email. We have been receiving a lot of great emails from all of you relaying questions for our guests and companies. Please keep them coming! Our email addresses are Shad@kereport.com and Fleck@kereport.com.

- Segment 1 and 2 – Peter Boockvar, CIO at Bleakley Financial Group and Editor of The Boock Report joins us to look into 2023 when the Fed stops hiking rates (assuming thereafter rates are held steady for a period of time). We focus on the market environment with generally higher interest rates, where inflation will be at that time and how different sectors perform.

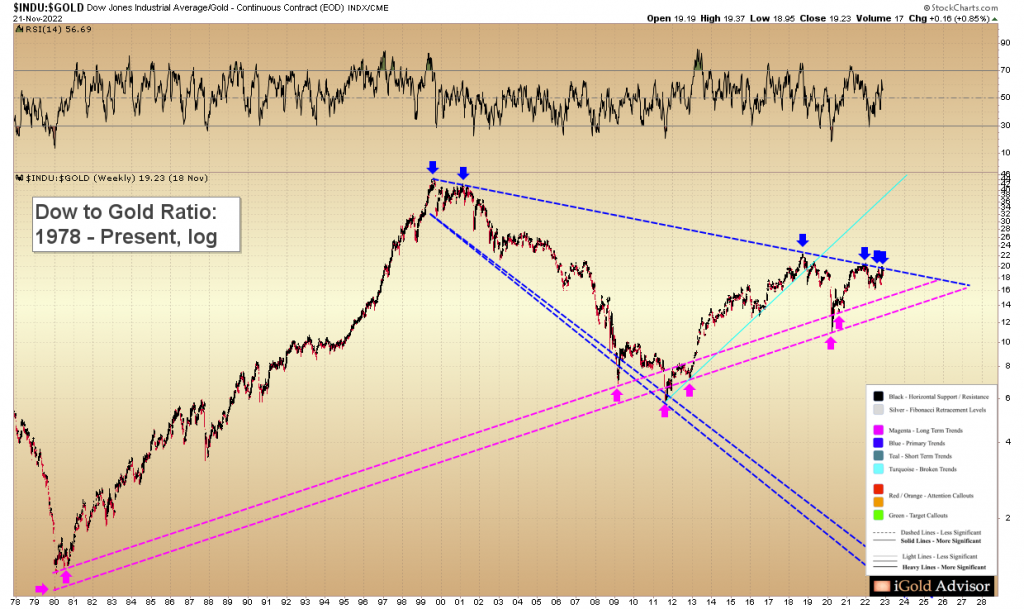

- Segment 3 and 4 – We wrap up the show by replaying an interview from Tuesday with Christopher Aaron, Founder of iGold Advisor and Senior Editor of GoldEagle.com. Christopher shares his big picture outlook for the precious metals. He sent us the Dow:Gold ratio chart, which is posted below, dating back to 1978. We also discuss a very important level broken in bond market that signifies the end of the 40+ year bond bull market.

Exclusive Company Interviews This Week

- Enduro Metals – New President Will Slack, Initial Results From The 2022 Drill Program At The Newmont Lake Project In The Golden Triangle

- I-80 Gold Corp – Bonanza-grade Drill Intercepts Returned From CRD Mineralization At The Hilltop Zone

- Goldshore Resources – Reviewing The Recent Maiden Resource Estimate And Ongoing 100,000 Meter Drill Program

- Thor Explorations – Comprehensive Exploration Update At The Douta Development Project

- Skeena Resources – Recapping Drill Results From November, Multiple Discoveries And Resource Extension Results

- Eloro Resources – Acquisition Expands The Iska Iska Property, Drill Results Grow The High Grade Feeder Zone

- Hemisphere Energy – Recapping A Solid Year Of Oil Production Growth, Increasing Free Cash Flows, Paying Off Debt, Initiating A Dividend, And Share Buybacks

- Enterprise Group – Comprehensive Company Overview, Areas For Growth, And Financial Strength

Peter Boockvar

Christopher Aaron

|

More

More

Religion & Spirituality

Religion & Spirituality Education

Education Arts and Design

Arts and Design Health

Health Fashion & Beauty

Fashion & Beauty Government & Organizations

Government & Organizations Kids & family

Kids & family Music

Music News & Politics

News & Politics Science & Medicine

Science & Medicine Society & Culture

Society & Culture Sports & Recreation

Sports & Recreation TV & Film

TV & Film Technology

Technology Philosophy

Philosophy Storytelling

Storytelling Horror and Paranomal

Horror and Paranomal True Crime

True Crime Leisure

Leisure Travel

Travel Fiction

Fiction Crypto

Crypto Marketing

Marketing History

History

.png)

Comedy

Comedy Arts

Arts Games & Hobbies

Games & Hobbies Business

Business Motivation

Motivation